Simplified Lending signs $10MM deal with RF to expand loan portfolio

With more businesses turning to alternative sources of funding, Simplified Lending, one of the fastest-growing financial services companies in The Bahamas, announced today it has boosted its ability to provide funding to Bahamians by signing a $10 million deal with RF Merchant Bank and Trust.

The announcement of the deal came in a joint statement issued by Simplified Lending and RF Bank and Trust (Bahamas) Limited “RF”. The arrangement will give Simplified, which has fueled its dramatic growth on brokering commercial loans, brokering for non-resident mortgages and lending directly to individuals in the private and public sector, greater lending power of its own to assist more Bahamians to achieve their goals.

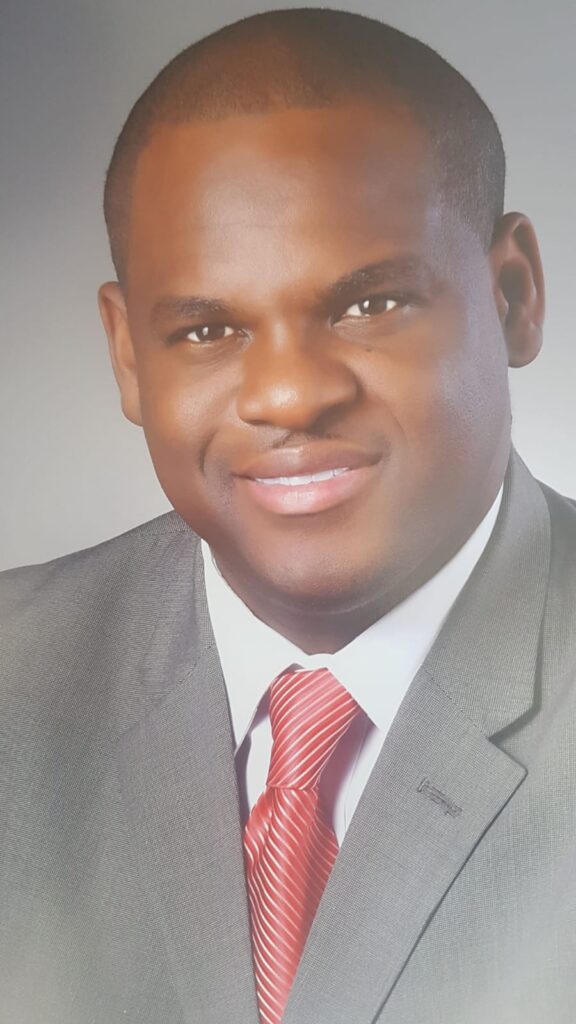

“We are very pleased to announce that following lengthy discussions focused on long- and short-term complementary goals, Simplified Lending and RF Bank and Trust have signed a mutually beneficial agreement that will allow Simplified to grow its loan portfolio and provide alternative funding for individuals,” said Simplified Lending’s founder and CEO Robert Pantry.

RF President and CEO Michael Anderson explained, “RF is focused on growth and that means being open to innovation. The financial landscape is changing before our eyes. There will be greater call for short-term loans, equity positions, asset assignment and alternative means of funding that do not fit the culture of traditional banks,” said Anderson. “We are pleased to support Simplified Lending in its efforts to provide innovative sources of capital to local businesses, entities and individuals.”

Simplified Lending, with offices in the JFK Plaza on University Drive, was founded three years ago by Pantry who climbed the ladder of success and recognition in traditional banking by the time he was in his mid-30s. At the age of 25, Pantry was the youngest ever to win the Minister’s Award for Excellence in the financial services industry and at 34 was the youngest person to ever hold the position of managing director of a major financial institution. Prior to launching Simplified, he held regional roles with two international financial institutions where he had responsibilities covering The Bahamas, Cayman, Turks and Caicos and the British Virgin Islands.

Pantry called the deal with RF strategic, saying it would help the company to continue to diversify its offering.

“Just as importantly,” he noted, “it will better drive growth and innovation in the market which is crying out for innovative solutions to help Bahamians post pandemic. This can bolster the country’s economy by cushioning individuals and contributing to the improvement of the GDP. For us, it is always about four pillars — people, businesses, community and country. Our strategy is if we improve any one of those four pillars, eventually it will touch and strengthen the others.”

While alternative funding is a growing part of its portfolio, Simplified Lending continues to work closely with local retail banks for clients who look to the company for mortgage brokering services. Its relationship with regional funding providers is paying off for businesses less likely to fit a local bank’s risk appetite post-COVID 19. That regional funding is also helping government.

About RF

Since its inception in 1997, RF has been committed to helping our clients create and manage wealth. We are your regional private bank connecting clients in The Bahamas, Barbados and the Cayman Islands with the best in local and international investments. Collectively, we have helped clients raise in excess of USD $2 Billion in capital and we have $2 Billion+ assets under administration. Offering a wide range of investment products and services, our financial solutions are designed to help individuals and corporate clients meet and achieve their investment goals.

These include Mutual Funds, Investment Management. Investment Banking, Group & Personal Pension Plans, Personal Retirement Accounts, Stock Brokerage, Trust & Estate Planning,

Educational Investment Accounts.